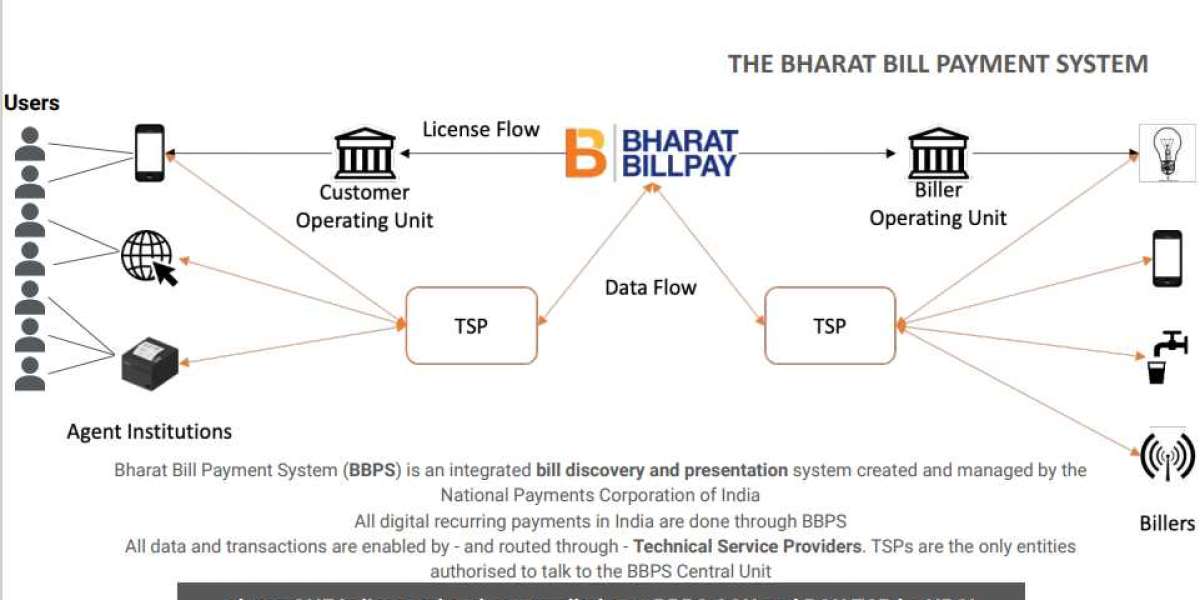

The Bharat Bill Payment System (BBPS) has revolutionized the way consumers pay their bills by offering a unified and interoperable platform for multiple services. Within this ecosystem, Agent Institutions (AIs) play a pivotal role in connecting consumers to the BBPS framework, ensuring convenience, reliability, and wide accessibility.

In this blog, we’ll explore the concept of Agent Institutions under BBPS, their roles, benefits, and how they contribute to the seamless functioning of this innovative payment system.

What is an Agent Institution under BBPS?

An Agent Institution BBPS (AI) is an entity that serves as an interface between customers and the BBPS. These institutions facilitate bill payment services through their extensive network of agents, providing users with access to BBPS at multiple touchpoints.

Typically, AIs work under a BBPOU (Bharat Bill Payment Operating Unit), which is a certified entity authorized to operate under BBPS guidelines. Together, BBPOUs and AIs ensure that the BBPS network operates smoothly and efficiently.

Key Roles of Agent Institutions

Providing Accessibility:

AIs operate through a network of agents (physical locations, online platforms, or mobile applications) to ensure BBPS services are available across urban and rural areas.Customer Facilitation:

They assist customers in making payments for electricity, water, telecom, gas, DTH, insurance premiums, and other utility services.Payment Processing:

AIs collect payment data and securely transmit it to BBPS through the respective BBPOUs. This enables real-time processing and confirmation of payments.Expanding Digital Literacy:

Many AIs help educate customers, especially in rural areas, about the benefits of digital payments and BBPS, thus promoting financial inclusion.Revenue Generation:

By charging a nominal fee for their services, AIs generate revenue while offering value-added services to end-users.

How Do Agent Institutions Operate?

Agent Institutions rely on two main setups:

Physical Agents:

Retail outlets, kirana stores, or customer service points that provide over-the-counter bill payment services to customers.Digital Platforms:

Websites, mobile applications, or chat-based platforms offering online bill payment services directly integrated with the BBPS.

Both methods ensure that customers have diverse options for accessing BBPS services, catering to their unique needs and preferences.

Benefits of Agent Institutions under BBPS

- Convenience: Customers can pay bills from a single platform, eliminating the need to visit multiple service providers.

- Wide Reach: With a strong presence in rural and semi-urban areas, AIs enhance the accessibility of bill payment services.

- Real-Time Transactions: Payments made through AIs are processed instantly, ensuring timely credit to billers.

- Secure Payments: Transactions facilitated by AIs adhere to the stringent security protocols mandated by BBPS.

- Transparency: Customers receive instant confirmations and receipts for their transactions, promoting trust.

Challenges Faced by Agent Institutions

Despite their benefits, Agent Institutions face certain challenges:

- Operational Costs: Managing a large network of agents involves significant costs, including training, technology, and compliance.

- Digital Divide: Limited digital literacy in rural areas may hinder customers' ability to fully utilize BBPS services.

- Technical Integration: Ensuring seamless integration with BBPOUs and the BBPS system requires robust technical infrastructure.

Accelerate Agent Institution Onboarding with plutos.One BBPS TSP

plutos.One empowers Agent Institutions by delivering a comprehensive and flexible BBPS solution tailored to meet business needs. It combines cutting-edge technology with a seamless deployment process, enabling businesses to:

- Add Bill Payments with Ease: Integrate BBPS bill payment functionality into your platform without the hassle of building infrastructure from scratch.

- Leverage Ready-to-Deploy Screens: Get pre-designed, customizable screens for mobile apps, websites, WhatsApp, and other platforms.

- Boost Engagement with Incentives: Every transaction comes with integrated incentives to drive user retention and increase repeat usage.

Whether you’re a digital platform, a fintech startup, or a traditional business looking to expand your services, plutos.One’s AI-as-a-Service can help you deliver exceptional bill payment functionality to your consumers with ease and efficiency.