To improve the chance of loan approval, debtors ought to focus on enhancing their credit score score, decreasing current debt, and demonstrating stable income.

To improve the chance of loan approval, debtors ought to focus on enhancing their credit score score, decreasing current debt, and demonstrating stable income. This can involve practices such as timely bill funds, paying down bank card balances, and maintaining regular employment. Additionally, buying around and comparing multiple lenders may help find better phrases and doubtlessly improve probabilities of appro

One such platform is 베픽, which makes a speciality of gathering comprehensive knowledge on same-day loans. This website supplies users with a wealth of knowledge, helping people perceive

Loan for Bankruptcy or Insolvency phrases, interest rates, and reputable lending establishments. With comparisons of assorted

이지론 lenders and their offerings, 베픽 permits debtors to make knowledgeable selections based on their circumstan

One of the defining features of cellular loans is the speed of approval. Many platforms offer instant selections, typically inside minutes, permitting borrowers to access funds much faster than traditional loans. Additionally, cell loans cater to numerous monetary wants, whether it's for personal expenses, emergencies, or even bigger purchases. The flexibility in loan quantities and compensation terms is an additional advantage, making them versatile financial soluti

Potential debtors must carefully assess their capability to repay the mortgage quantity before committing. Creating a price range and understanding one’s monetary capabilities can stop falling right into a cycle of debt that is onerous to f

Furthermore, unsecured loans can be utilized for a wide range of purposes. Whether for home enhancements, medical bills, education, or consolidating present debt, the flexibility of these loans makes them interesting to a variety of borrowers. Additionally, for the rationale that borrower just isn't tying up any assets, it can be a much less stressful option in comparability with using a secured mortg

Furthermore, when used properly, credit score loans can enhance your credit rating. Timely payments reveal your capability to handle debt responsibly, which can lead to higher borrowing phrases sooner or la

Most lenders supply funds nearly immediately upon approval of the loan software, usually within a quantity of hours. Some lenders might require further verification, which might delay funding. It's finest to check with the lender about their specific timelines for disbursem

Understanding the Application Process

The utility process for same-day loans is often designed to be user-friendly, especially for online functions. Borrowers are often required to offer private info, together with name, tackle, revenue details, and banking information. Additionally, some lenders might ask for identification and proof of revenue to verify the applicant's financial situat

Moreover, failure to repay an unsecured mortgage can have extreme penalties for a borrower’s credit score score. Missing payments or defaulting on the mortgage can end result in a drastic reduction in creditworthiness, making it tougher to safe loans sooner or later. Interest charges also can improve, compounding the problem of d

In essence, freelancer loans empower unbiased staff to take care of monetary stability despite the unpredictability of freelance income. It's essential for freelancers to do their research and choose a loan that aligns with their specific needs and monetary situat

In addition, BePix options consumer critiques and testimonials that provide real-life insights into personal experiences with lenders. This community-driven method makes it simpler for borrowers to pick out the absolute best choice primarily based on shared information and experien

Key Benefits of Freelancer Loans

Freelancer loans include a spread of benefits tailor-made to fulfill the needs of unbiased staff. Firstly, they supply access to fast capital when needed. Unlike typical loans, which can take weeks for approval, freelancer loans can usually be processed shortly, providing funds in a matter of d

Who Should Consider a Same-Day Loan?

Same-day loans could also be a viable choice for those experiencing instant financial distress. Individuals who face sudden bills, corresponding to sudden medical bills or pressing car repairs, would possibly find same-day loans to be a sensible answer to bridge gaps of their finan

Another important factor is the borrower’s revenue level. Lenders prefer applicants who have a gradual income that comfortably exceeds their monthly obligations, ensuring that mortgage payments could be met with out monetary stress. Additionally, the size of employment can also weigh in favor of the applicant. Lenders view job stability favorably when assessing r

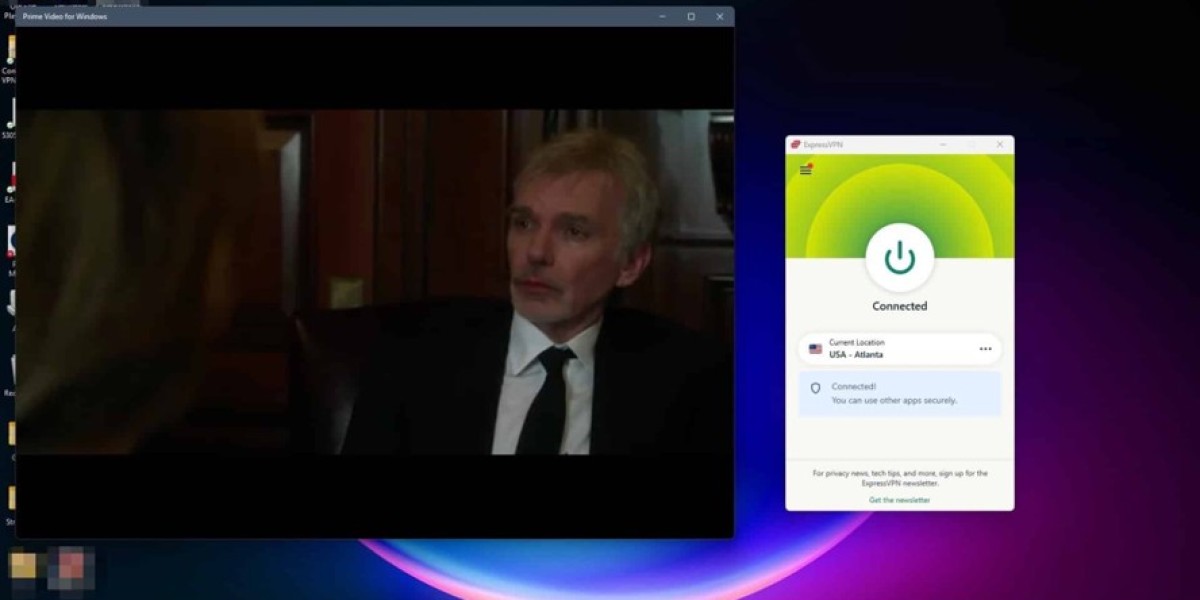

Mobile loans may be protected, provided you select a reputable lender. It's essential to do thorough research, learn critiques, and understand the phrases earlier than committing. Platforms like 베픽 can assist in figuring out reliable lenders, enhancing your safety while borrow

Диплом о высшем образовании за короткий срок

על ידי worksale

Диплом о высшем образовании за короткий срок

על ידי worksale 上海狗友吸尘器哪个牌子好

על ידי hthtgthh

上海狗友吸尘器哪个牌子好

על ידי hthtgthh Ваш диплом без лишних забот: быстро и безопасно

על ידי worksale

Ваш диплом без лишних забот: быстро и безопасно

על ידי worksale Как выбрать надежный интернет магазин, реализующий дипломы?

על ידי sonnick84

Как выбрать надежный интернет магазин, реализующий дипломы?

על ידי sonnick84 Как можно будет быстро приобрести аттестат в онлайн магазине

על ידי sonnick84

Как можно будет быстро приобрести аттестат в онлайн магазине

על ידי sonnick84